A beginner’s guide to cryptocurrency

If you are new to the world of cryptocurrencies, a beginner’s guide to cryptocurrency will help you understand the fundamentals of the technology. Digital money is decentralized and isn’t regulated by a central authority. It is governed by users of a decentralized exchange or blockchain. A beginner’s guide to cryptocurrency will explain how this works and give you a better understanding of the different types of cryptocurrencies.

There are many different types of cryptocurrency. You can buy and sell goods and services with them, or exchange them for other cryptocurrencies. The regulatory climate is constantly changing, and you should always check with your local regulator before you invest. Also, be sure to only put in money that you can afford to lose – if you have no experience, you could find yourself losing your money. If you have any doubts about whether cryptocurrency is right for you, it is best to find a beginner’s guide.

If you’re not sure what cryptocurrency is, you can begin by reading a beginner’s guide to cryptocurrency. There are many different forms of digital currency. Unlike traditional currencies, cryptocurrencies are not controlled by central agencies or governments. They are stored in a massive digital book, which can be accessed by anyone. Because of the decentralized nature of the technology, they’re secure and cannot be easily stolen. A beginner’s guide to cryptocurrency will help you understand the ins and outs of this new type of money.

What is cryptocurrency?

In a nutshell, cryptocurrency is a digital asset with a decentralized ledger system. Each transaction is recorded on a public ledger and the entire network can view it. In addition, data on individual transactions are encrypted with cryptography. This makes it difficult for fraudsters to steal your private keys. This means that you can never lose your money. If you want to know more about cryptocurrency, read on to learn more about the benefits.

Cryptocurrency is an online currency, which is not held in any physical form. Instead, it is recorded on a public blockchain, which records all transactions without identifying factors. The data on the blockchain is highly encrypted, which means that you cannot easily copy it and use it in everyday transactions. This makes cryptocurrency a great investment because it does not need a centralized entity to be secure. It also makes it possible to avoid the risks associated with fiat currency, which is why it is so popular with consumers and businesses alike.

The biggest drawback of cryptocurrency is that it does not physically exist. Some have compared it to blinker light fluid, which is a real thing, while others have compared it to an inert fluid. In other words, there is no tangible asset that resembles a piece of paper. In addition, there is no central authority or government backing it, so it is a completely speculative currency. Despite the fact that it has the potential to be very secure, it’s important to consider the risks associated with it.

How Does Cryptocurrency Work?

The blockchain is the foundation of cryptocurrency, a decentralized ledger where transactions are recorded in code and distributed across millions of computers worldwide. Each transaction is recorded in a block, which is linked on a “chain” of previous ones. Every user of cryptocurrency has their own copy of the blockchain book, which is updated with new information simultaneously. The process is secured by proof of the stake, which ensures that each transaction is verified.

To secure transactions, crypto miners store the data on their computers and turn it into less discernible forms. The end-user then converts the data back into its original form, thereby eliminating the possibility of counterfeiting or double-spending. In this way, cryptocurrency functions as a decentralized cloud-based filing system. Its lack of affiliation with a central government or centralized third party eliminates the need for interactions with any third-party servers. As a result, the process is private and anonymous.

A cryptocurrency’s value is determined by its supply and demand. The supply and demand of the currency will affect its value, and the amount of each currency will fluctuate. In contrast, a traditional bank account will have no value. In this way, the currency will always be a stable store of value and may be sold at any time. This means that it is a very reliable investment. However, it is important to note that this method does not allow for easy hacking.

What Are Cryptocurrency Examples?

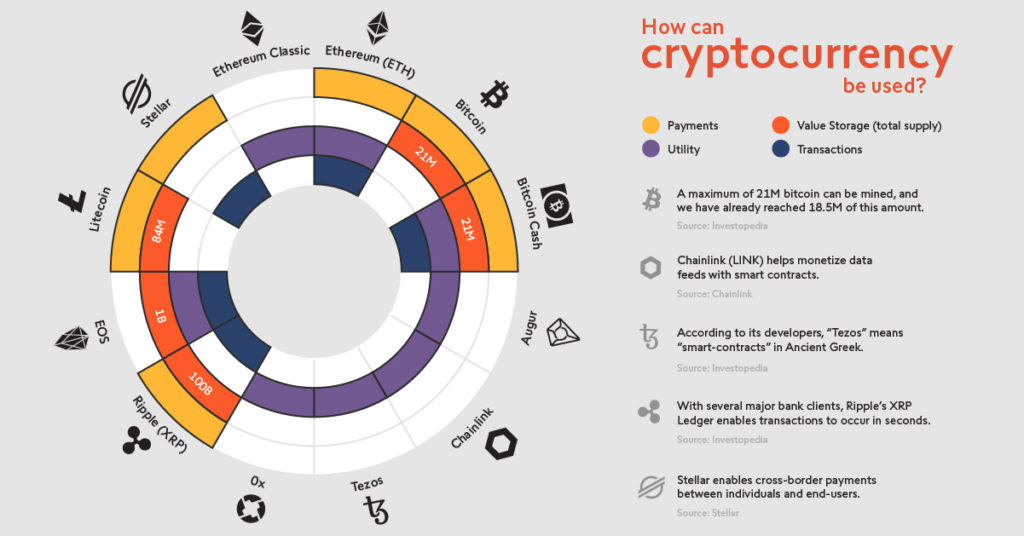

There are many popular cryptocurrency examples. These include Bitcoin, Ethereum, XRP, Dogecoin, Ripple, and Litecoin. All of these digital assets function like regular currencies, and they are not regulated by any central authority. The Bitcoin example is the most well-known, but other cryptocurrencies are on the rise. Even if the Indian government is not yet ready to legalize cryptocurrency, it will still be a long time before it does. While Microsoft and WordPress accept Bitcoin as payment, Tesla is against it.

In addition to being a medium of exchange, cryptocurrencies are digital assets that are not directly backed by a central bank or other government. Their primary goal is to secure financial transactions and to control the creation of additional units. In addition, cryptocurrencies are often volatile in price, as there is no intrinsic value. Regardless of the purpose of a particular cryptocurrency, it functions on a blockchain and is held in a wallet.

A cryptocurrency is a digital asset similar to a computer file. Its purpose is to ensure that no one can spend more money than they have. It also solves a major problem in conventional banking: the Double Spend Problem. With cash, counterfeiters can copy money and paste it into another. With digital money, you can’t duplicate it, so there is no risk of losing your hard-earned cash. While you can trade the same coin for another, you should always research the type and function of the asset before making a purchase.

How to Buy Cryptocurrency Step-By-Step

Buying cryptocurrency is easier than ever. The world is flooded with exchanges and wallets. But there’s no need to be intimidated. There are many online resources for buying cryptocurrencies and there’s no need to feel alone. We’ll break it down for you step-by-step. First, select the cryptocurrency you want to buy. Once you’ve chosen your crypto, you can choose your payment method. Many exchanges accept credit cards and debit cards. You should review each method’s fees and choose the one that best fits your needs.

When you purchase a cryptocurrency, you’ll need to deposit funds into your account. You can do this by linking your bank account and authorizing a wire transfer. You can also use your debit or credit card to deposit funds. It may take a few days to process these deposits. Once you’ve deposited your money, you can begin buying cryptocurrency. To avoid losing your money, make sure your wallet has a secure location to keep your crypto.

You can also buy cryptocurrency with a credit card. Some exchanges allow you to deposit funds using a credit card. Credit card companies will process your purchase as a cash advance, which means you’ll be charged higher interest rates and cash advance fees. In addition, you’ll also have to pay a fee for the cryptocurrency exchange or brokerage. These fees can add up to five percent of your total transaction. This can make the process of buying a cryptocurrency a little more complicated than it needs to be.

How to Own/ Store Cryptocurrency

There are several different ways to store your cryptocurrency. While they are all referred to as ‘wallets’, these are more like maps to where your funds are located than anything else. Because the location of your funds is public, anyone with access to your wallet can access the funds. Another important concept in crypto storage is the private and public keys. These keys are used to ensure that no one else can access your funds. Keeping them separate is crucial for your safety.

You can store different types of cryptocurrency in different locations. You may use exchanges and shift assets between wallets. This will allow you to keep a record of your transactions. You can also make backup copies of your crypto in different places. Choosing the right location is essential to protecting your assets. Keeping your digital currency safe and secure is the key to avoiding theft. While it’s important to consider security and price when storing your assets, it’s even more important to protect them from tampering.

Choosing the right wallet is important for your security. You’ll need to protect your crypto against theft. Some experts recommend using hardware wallets. Other wallets are virtual. The best ones have two types of interfaces. In the virtual realm, you will need a mobile app to access your cryptocurrency. Then, choose a location with secure storage. In addition to the physical location, you’ll need to choose a storage option. There are both physical and virtual cryptocurrency wallets.

5 Best Crypto Apps For Traders & Investors For Android and iPhone

There are several different crypto trading applications available on mobile phones, but the 10 Best For Traders & Investors are based on various aspects. Listed below are some of the most popular apps for cryptocurrency traders and investors. You should check each app’s features before making a decision. There are some that are essential for new users, while others are not. If you want to become a professional investor, however, you should consider investing in a professional exchange.

The most important feature for a cryptocurrency trading app is security. The best crypto platform will have excellent security features, like keeping your assets offline in cold storage. Some platforms are also insured against loss or theft. These apps are very safe and can help you make informed decisions when trading. The 5 Best Crypto Apps For Traders and Investors for Android and iPhone are listed below. We hope you find one that meets your needs!

The Future Of Cryptocurrency

The Future of cryptocurrency is largely uncertain, but some things are clear, even with the growing number of new entrants to the crypto space. First and foremost, a thriving cryptocurrency ecosystem depends on a steady and planned demand. This is not to say that crypto is a bubble. It is a commodity like any other and is subject to fluctuations. However, with a rising number of users, the future of crypto is definitely bright.

The growth of cryptocurrency is likely to be driven by the e-commerce, retail, and trading segments. Blockchain technology will allow decentralization in these sectors, disrupting the dominance of Big Tech. The advent of decentralized payment services will give consumers more choice when buying goods and services online and will give them true digital privacy. As the world becomes more connected, cryptocurrencies will be the primary vehicle for e-payment.

Another factor contributing to the growth of cryptocurrency is the looming threat of a global pandemic. While the US is tackling the problem of overspending, its government has not yet embraced it. While the future of cryptocurrencies is uncertain, the current boom in cryptocurrency has provided the opportunity for individual and brand-level businesses to diversify their portfolios. While many people have a cynical view of cryptocurrency, the overwhelming majority of experienced investors believe it is here to stay.