KEY LEARNINGS

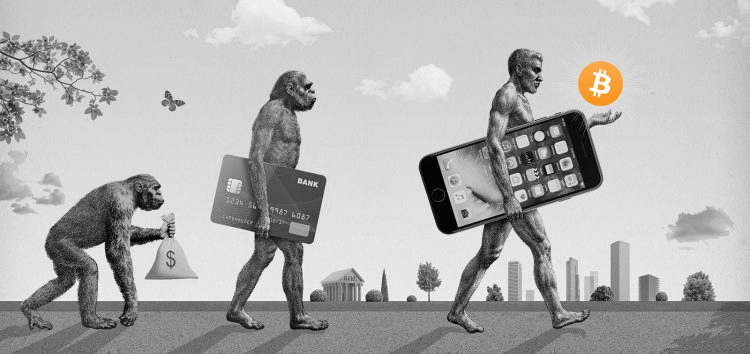

Bitcoin has increased by nearly 70% since 2021, bringing the total crypto market to $2 trillion.

However, bitcoin’s prospects have been hampered by increased regulatory scrutiny and extreme price fluctuations.

Experts believe that bitcoin will see a sharp drop in the next few months.

- Bitcoin has had an excellent year. The value of the whole crypto market has risen to $2 trillion since 2021 when the digital currency was almost 70% higher than it was at the beginning.

- This year has seen Coinbase go public in April and Wall Street banks like Goldman Sachs increase their participation. Also, the U.S. approved the first exchange-traded bitcoin fund.

- But, increased regulatory scrutiny, as well as severe price fluctuations, have slowed bitcoin’s prospects. Experts warn that the market is on the verge of a decline.

- CNBC examines the top predictions of analysts for next year, which already looks like another roller-coaster ride for digital currencies.

CRYPTO CRASH

Experts believe that bitcoin will see a sharp drop in the next few months.

In November, the cryptocurrency reached a record height of nearly $69,000. The cryptocurrency is now trading below $50,000, almost 30% down from its peak. According to Wall Street wisdom, bear markets are a 20% decline from the recent highs. However, it is worth noting that bitcoin is well-known for its volatility.

Professor of Finance at Sussex University Carol Alexander said that bitcoin could plummet to $10,000 by 2022, essentially wiping out its gains over the past year.

Alexander stated that if she were an investor, she would consider selling bitcoins soon as the price is likely to crash next year. Alexander’s bearish view is based on the belief that bitcoin “has no fundamental value” and acts more as a “toy” rather than an investment.

Alexander warned that history could repeat itself. After climbing to nearly $20,000 just a few months prior, bitcoin plummeted to $3,000 in 2018. Many of the cryptocurrency’s backers claim that things have changed this time around as more institutional investors are entering the market.

“Without doubt, Bitcoin’s prices chart seems to follow many historical asset booms and busts, and is carrying a ‘this time it’s different’ narrative just like other bubbles,” stated Todd Lowenstein (chief equity strategist at Union Bank’s private bank arm).

One common use for bitcoin as an investment is to hedge against rising inflation due to government stimulus. Lowenstein stated that there is a possibility that a more hawkish Federal Reserve could take bitcoin’s sails.

He stated that “Goldilocks conditions” are ending and that the liquidity tide was receding. This will adversely affect overvalued assets and speculative markets, including cryptocurrencies.

However, not all are convinced that the crypto party will end by 2022. Yuya Hasegawa from Bitbank, a crypto market analyst, stated that the Fed’s quantitative tapering is the biggest risk factor.

ETF First Spot Bitcoin

The approval of the first spot Bitcoin exchange-traded fund in America is a major development that crypto investors are looking for in 2022.

The launch of ProShares’ Bitcoin Strategies ETF was approved by the Securities and Exchange Commission. However, the product tracks bitcoin futures contracts and does not give investors direct exposure to cryptocurrency.

Futures are financial derivatives that require investors to purchase or sell assets at a future date and at an agreed-upon rate. Experts say ProShares’ ETF tracks futures prices rather than bitcoin. This could pose a risk for novice traders who are often invested in crypto.

Vijay Ayyar (Vice President of Corporate Development at Crypto Exchange Luno), stated that the Bitcoin Futures ETF launched this year was not retail-friendly due to the high cost of rolling over contracts, which amounts to approximately 5-10%.

“Increasing pressure/evidence…points to a Bitcoin Spot Exchange Trade Fund being approved in 2022, primarily because the market is large enough to support one.”

Grayscale Investments filed to convert the bitcoin trust which is the largest bitcoin fund in the world, to a spot ETF. There are many other bitcoin ETF applications in the works.

Rotation into ‘DeFi’

As the crypto industry evolves, bitcoin’s market share has decreased. However, other digital currencies such as ethereum have played a larger role. Analysts expect this trend to continue into next year as investors look for smaller pockets of crypto to make big profits.

Alexander, from Sussex University, flagged ethereum and solana as coins to be on the lookout for in 2022.

She stated that as retail investors realize the risks of trading bitcoin on unregulated platforms, they will switch to other coins from blockchains, which serve an essential and fundamental function in decentralized finance.

Alexander said that “this time next year, I predict bitcoin’s market capital will be half of the combined cap smart contract coins” such as ethereum or solana.

Bryan Gross, ICHI’s network steward, said that emerging crypto developments like decentralized finance and decentralized autonomous organizations are “likely” to be the most lucrative. DeFi’s goal is to create traditional financial products with no middlemen. DAOs, on the other hand, can be viewed as a new kind of internet community.

For the first time, total money in DeFi services exceeded $200 billion. Experts predict that demand will grow even more in 2022.

The trend of Web3 is DeFi. Web3 is a movement that calls for a new decentralized internet. It includes blockchain and cryptocurrency technologies like nonfungible tokens. However, it has already been questioned by Elon Musk as well as Jack Dorsey.

“A huge year on the regulatory front”

This year saw regulators flex their muscles on cryptocurrency, with China banning all crypto-related activities, and the U.S. authorities crackingdown on certain market aspects. Most analysts expect regulation to be a major issue for the sector in 2022.

Luno’s Ayyar stated that “2022 is going to be a huge year on the regulatory front,” “The interest of various governments, especially the U.S. to regulate the crypto space has never been greater.”

Ayyar stated that he hopes to get clarifications on the legal “gray area” of cryptocurrency other than bitcoin and Ethereum, which Ayyar claimed are securities.

Ripple, a blockchain company, is negotiating with the U.S. watchdog about XRP. XRP is a cryptocurrency it is closely linked with. Ripple, two of its executives and XRP are accused of illegally selling $1.3 billion of tokens. Ripple, for its part, says XRP shouldn’t be considered a security.

Experts believe that stablecoins will be another area of focus for regulators in the coming year. These tokens are tied to existing assets such as U.S. dollars. Tether, the largest stablecoin in the world, is controversial because there are questions about its ability to hold enough assets to support its peg to USD.

Lowenstein stated that stable coins will be subject to greater scrutiny as regulators examine the soundness and leverage of the collateral.

“People will always remember the time when the collateral that was behind the mortgage and housing crises was suspect and risk appetites were aggressively re-priced.”

In the meantime, regulators have begun to examine DeFi space. The Bank for International Settlements, a central bank umbrella organization, called for the regulation of DeFi earlier this month. It stated that it is concerned about services being marketed as “decentralized” while in fact, that could not be true.

To Learn About Crypto Check out Cryptocurrency Investment – A Complete Guide