Non-fungible tokens, or NFTs, are cryptographic assets stored on a Blockchain. They have unique identification codes and metadata that differentiate them from one another. They cannot be traded or exchanged at the same time as cryptocurrencies. This is different from fungible tokens such as cryptocurrencies which can be traded or exchanged at equivalency.

Understanding NFTs

Cryptocurrencies are like physical money. They can be traded and exchanged one for the other, just as physical money. One Bitcoin, for example, is equal in value to the other Bitcoin. A single Ether unit is also equal to another. This makes cryptocurrency a suitable medium for digital transactions.

NFTs change the crypto paradigm by making every token unique and irreplaceable. This makes it impossible to have any non-fungible token be identical. Because each token has a unique identity that is non-transferable, it can be compared to digital passports. They can also be combined with other NFTs to create a third unique NFT.

Similar to Bitcoin NFTs contain ownership details that allow for easy identification and transfer among token holders. NFTs allow owners to add metadata and attributes that relate to their assets. Fairtrade tokens, for example, can be classified as tokens representing coffee beans. Artists can also sign digital artwork with their signature in the metadata.

ERC-721 was the basis for NFTs. ERC-721 was developed by the same people who created the ERC-20 smart contracts. It defines the minimum interface (ownership details, security, metadata) required to exchange and distribute gaming tokens. The ERC-1155 standard extends the concept by reducing transaction and storage costs and batching multiple non-fungible tokens in a single contract.

Cryptokitties is perhaps the most well-known use case for NFTs. Cryptokitties were launched in November 2017 and are digital representations or cats with unique identifications on Ethereum’s blockchain. Each cat is unique and each one has its own price in ether. They breed among themselves and produce offspring with different values and attributes than their parents. In just a few weeks, cryptokitties had racked up an audience of 20 million who spent $20 million on ether to feed, nurture, and purchase them. Some people even spent more than $100,000 to support the effort. 5

Although the use of cryptokitties may seem trivial, successful ones can have serious business consequences. NFTs can be used for private equity transactions and real estate transactions, among other things. The ability to provide escrow to different types of NFTs (from artwork to real property) in one financial transaction is one of the consequences of allowing multiple types of tokens to be included in a contract.

How to Buy NFTs

An NFT can be bought for any digital image. There are some things you should consider before purchasing one, especially if this is your first purchase. It’s important to choose the right marketplace, which digital wallet you need to store it, and what cryptocurrency you need to close the deal.

How do you sell NFTs

NFTs can also be sold through marketplaces. The process may vary from one platform to the next. Upload your content to a marketplace and follow the instructions to make it an NFT. Specific information such as a description and pricing suggestions will be possible. The majority of NFTs can be purchased with Ethereum, but you can also buy them using other ERC-20 tokens like WAX or Flow.

The Future Is The Metaverse

Andrew Lokenauth, an NFT investor, says that big brands spend a lot of money on NFTs because the digital future is the future.

He says that there are already large numbers of people who spend hours each day in virtual worlds and these numbers will only continue to grow. Brands see the value of marketing in the metaverse as a way to increase sales and have done so.

Lokenauth mentions that many well-known artists have performed concerts in the Metaverse such as Justin Bieber and Travis Scott, the Weeknd and Ariana Grande.

He says, “Perhaps high-fashion companies will be the next and hold fashion shows throughout the metaverse.” Brands are investing big because there are so many options.

Frequently Asked Questions (FAQs).

What are some non-fungible tokens you can use?

Digitally representing any asset can be done with non-fungible tokens, even digital assets such as digital artwork or real assets like real estate. NFTs also allow you to represent other assets such as avatars, digital collectibles and domain names.

What are the best ways to buy NFTs

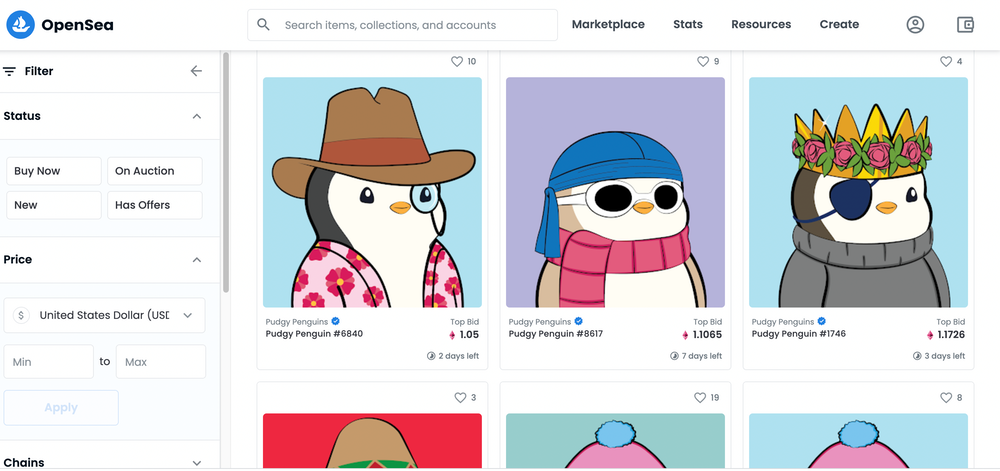

NFTs cannot be bought with Ether. Therefore, it is important to have some Ether and store it in a digital wallet. NFTs can then be purchased via any of the NFT marketplaces online, such as SuperRare, Rarible and OpenSea.

Are non-fungible tokens safe?

The non-fungible tokens that use blockchain technology, just like cryptocurrency, are generally safe. NFTs are difficult to hack due to the distributed nature of blockchains. NFTs have one security risk: you may lose access to your non-fungible token in the event that the platform hosting them goes out of business.

Is this a bubble or not?

Beeple, whose real name was Mike Winkelmann, told the BBC that he believed there would be a bubble a day before his record-breaking auction.

“And I believe we could be in that Bubble right now.”

Others are even more skeptical.

David Gerard, the author of Attack of the 50 foot Blockchain, stated that NFTs were like buying “official collectables” similar to trading cards.

He warned that “there are artists who make a lot of money from this stuff… it’s just not likely to happen.”

He said that the people who actually sell NFTs are “cryptogrifters”.

“The same guys who have been doing it for years, trying to invent a new type of magic bean that is worthless and can be sold for money.

Charles Allsopp, a former Christie’s auctioneer, said that buying NFTs was “nonsense”.

He said to the BBC, “The idea that you buy something that isn’t there”

“I believe people who invest in it make a lot of money, but I hope they don’t lose theirs.”